AuPanda

Well-Known Member

- Joined

- Mar 22, 2010

- Posts

- 423

- Reaction score

- 1

Well this article is more than a little disappointing:

While Ford was making noise about not taking federal bailout money, they and other major automakers (both foreign and domestic) got federal aid to the tune of tens of billions of dollars when the economy tanked in 2008.

Yesterday, the federal government released the names of companies and the amounts of loans handed out during the financial crisis of 2008 to keep loans flowing as credit dried up everywhere. A number of those companies were the lending arms of automakers.

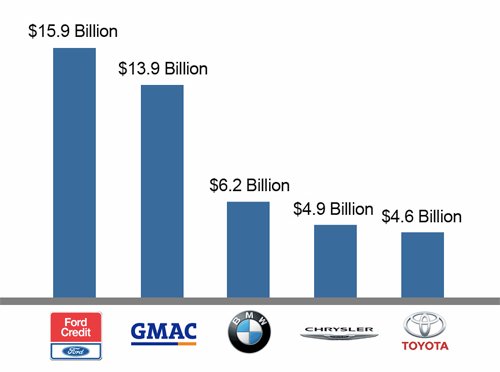

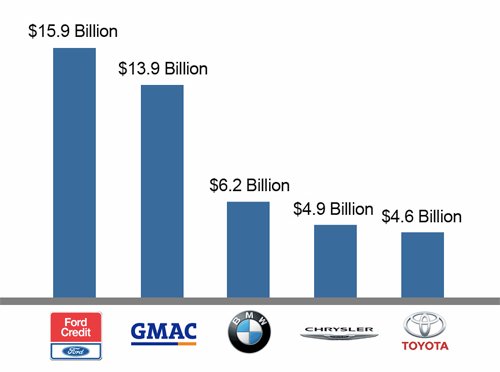

Automotive blog Jalopnik broke down which automotive lending companies got the most help, and leading the way was Ford Credit, which borrowed $15.9 billion. GMAC, GM’s financing arm which provided auto loans beyond the GM family of vehicles, took $13.9 billion. BMW took $6.2 billion. Chrysler $4.9 billion and Toyota $4.6 billion.

The GM and Chrysler loans were completely separate from those two companies’ government-financed bankruptcies.

While the news and numbers aren’t earth shattering — funds to the automotive lending companies totaled just $57.9 billion out of $3.3 trillion in TARP funds — it could color Ford’s perception as the only Detroit-based company that didn’t need a federal handout during the economic crash.

That’s a perception the company has fueled itself, by making statements about how not taking a “bailout” has been beneficial to its recent resurgence. We realize the two transactions are quite different, and this loan was not a bailout.

But we wonder how the public will see it.

All of this aid has since been repaid with interest to the government.

Graph courtesy of Jalopnik

http://blogs.cars.com/kickingtires/2010/12/report-ford-took-federal-funds-too.html

While Ford was making noise about not taking federal bailout money, they and other major automakers (both foreign and domestic) got federal aid to the tune of tens of billions of dollars when the economy tanked in 2008.

Yesterday, the federal government released the names of companies and the amounts of loans handed out during the financial crisis of 2008 to keep loans flowing as credit dried up everywhere. A number of those companies were the lending arms of automakers.

Automotive blog Jalopnik broke down which automotive lending companies got the most help, and leading the way was Ford Credit, which borrowed $15.9 billion. GMAC, GM’s financing arm which provided auto loans beyond the GM family of vehicles, took $13.9 billion. BMW took $6.2 billion. Chrysler $4.9 billion and Toyota $4.6 billion.

The GM and Chrysler loans were completely separate from those two companies’ government-financed bankruptcies.

While the news and numbers aren’t earth shattering — funds to the automotive lending companies totaled just $57.9 billion out of $3.3 trillion in TARP funds — it could color Ford’s perception as the only Detroit-based company that didn’t need a federal handout during the economic crash.

That’s a perception the company has fueled itself, by making statements about how not taking a “bailout” has been beneficial to its recent resurgence. We realize the two transactions are quite different, and this loan was not a bailout.

But we wonder how the public will see it.

All of this aid has since been repaid with interest to the government.

Graph courtesy of Jalopnik

http://blogs.cars.com/kickingtires/2010/12/report-ford-took-federal-funds-too.html