Badgertits

FRF Addict

You could’ve just said “because CA” & that’d be enough lolThe $93,642 was OTD for the 2021, which included a 5k ADM. I got the 2019 for 1k under MSRP. That was in California and I played the driving and calling around game, I wised up since. Even at that time, most dealerships in California wanted 15k over. It is not worth my time anymore. I agree with your market comment, I am waiting for a huge correction before I jump back in and it will happen.

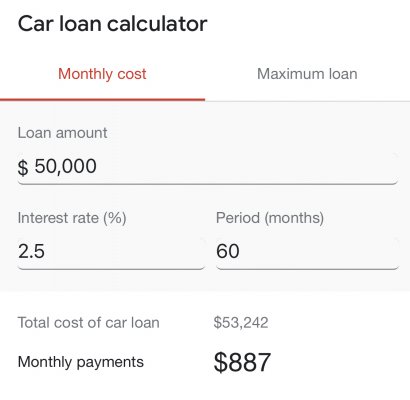

I agree good to just sit tight w/ what you have right now, although the last big move I may do is pulling some equity outta the house before rates skyrocket, probably wise & probably needs to be done in next month or so