SurfRaptor

FRF Addict

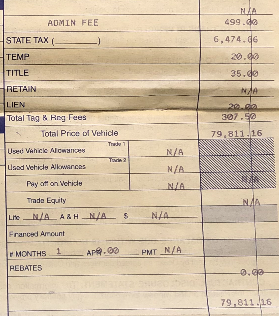

Can someone walk me through the process of registering and fees from out of state in CA. I live here in So Cal. Truck is ready for pickup. My dealer seems shady, so I want to make sure I am not paying double registration fees or a high rip-off registration price. Truck will be picked up in Delaware.

Does it get temporary DE plates and then I pay the difference between DE and CA? Sorry if this seems like a newbie question but my last new vehicle purchase was in state 14 years ago.

Does it get temporary DE plates and then I pay the difference between DE and CA? Sorry if this seems like a newbie question but my last new vehicle purchase was in state 14 years ago.