TwizzleStix

Pudendum Inspector aka FORZDA 1

August 2018 Issue

Back to Summary

Out with the Old: New Oil for New Engines

By Bob Chabot

Motor oil plays a critical role in maintaining the long-term health of the highly stressed engines in newer vehicles. Installing the correct oil has never been of greater importance.

Lubricants, particularly engine motor oils, have become a bit of a puzzle in the past few years. Making sense of the many changes that are in flux can be confusing for you, let alone trying to explain them to customers who own light-duty gasoline-powered cars and light trucks. In many cases, they view an oil change service as a generic commodity. They couldn’t be more wrong. Here’s what you and they need to know today.

Consider for a moment the recent trend toward downsized, gasoline direct injection (GDI) engines that are dominating sales in many vehicle segments today. In particular, focus on the European makes and models you currently service and repair in your shop.

Are you seeing an increase in carbon buildup on engine valves, cylinder blowby, piston scoring and deformation, engine sludge or other poor-quality lubricant-related issues? Are you increasingly selling induction cleaning services and other solutions that help address, but never prevent, those deteriorating incomplete combustion consequences?

Now riddle yourself this: Why are those same makes and models in Europe, which use Euro-spec motor oils, not experiencing the high incidences of these engine issues we are here? Keep your answer in mind as you read on, because we’ll come back to the service implications.

A Major Shift to TGDI

Over the last 15 years, you may have noticed a significant shift to downsized but more powerful GDI engines. But did you pick up on the big shift from GDI to turbocharged GDI (TGDI) engines? Adding turbocharging recovers energy that’s otherwise lost through exhaust systems, to achieve even greater fuel efficiency.

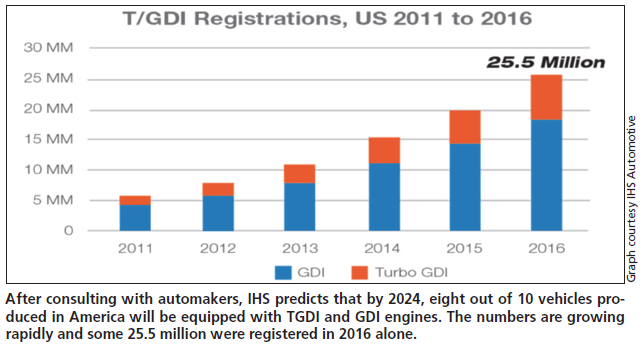

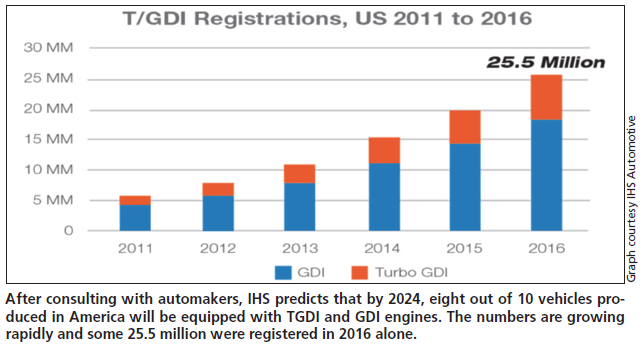

Consider this data shared by Mark Seng, Global Aftermarket Practice Leader for IHS Automotive, a leading market researcher: “In 2016, there were 25.5 million registered passenger cars in the U.S. powered by TGDI and GDI engines. By 2024, after consulting with automakers, IHS predicts eight out of 10 cars produced in America will be equipped with TGDI and GDI engines. By 2024, we expect that vehicles equipped with TGDI and GDI engines will make up 83% of the U.S. vehicle population. That’s the majority of vehicles coming through service facility doors for oil changes.”

Seng cited two market forces that are driving this automaker shift toward these smaller, lighter TGDI engines. First, automakers are formulating production plans designed to meet the challenging 2025 regulatory fuel economy requirement of 54.5 mpg. Second, consumer demand for more efficient and better performing engines has continued to grow.

TGDI engine technology delivers on both counts. A 4-cylinder TGDI engine can generate the same levels of torque as its 6-cylinder port fuel injected (PFI) counterpart. But that power comes at a price—a much harsher engine environment. TGDI engines produce greater cylinder pressures, higher operating speeds and higher sustained temperatures than PFI engines. Simply put, pistons and connecting rods are breaking.

“GDI and TGDI engines now make up over half of new-car production,” shared Mike Krampf, Finished Lube Manager for Phillips 66. “More than 120 million TGDI-powered vehicles have been manufactured since 2010. These are smaller and more powerful engines, but they also run hotter. In addition, the high pressures from turbocharging combined with direct fuel injection in these smaller TGDI engines make them susceptible to detrimental conditions.” For example:

To sustain the shift to TGDI engines, carmakers need motor oils engineered to prevent or sufficiently mitigate these issues—specifically, higher performing oils under TGDI

engine operating conditions, with improved oxidation control, cleaning and antiwear properties—so that combustion can be controlled.

Harsher Operating Conditions

Acronyms and terms like API, ILSAC, ACEA, GF-6B, SN Plus, SN Plus RC and others can be a confusing alphabet soup for those like us who just want an easy-to-understand guide to know what motor oil is best for the customers we serve.

The American Petroleum Industry (API) is the primary standards body for engine oil in North America only.

Its members include some automakers, lubricant manufacturers and additive makers. API uses an alphanumeric system to indicate superseding, backwards-compatible approval: API SN is newer than and can be used in older engines using API SM, which is newer than and can be used in older engines using API SL, etc.

Within API, the International Lubricants Standardization and Approval Committee (ILSAC) represents the interest of American and Japanese manufacturers. ILSAC also uses an alphanumeric system to indicate superseding, backwards-compatible approval: ILSAC GF-6 is newer than and can be used in older engines using ILSAC GF-5, which is newer than and can be used in older engines using GF-4, etc.

Historically, the API member automakers (domestic and Asian) have wanted a single lubricant designation for motor oil generations—categorized by specific viscosities, fuel economy benefits, emissions and engine oil robustness. Based on this request, the API developed the GF series of engine oil categories. The intent was (1) to use this system as a guide to reach common ground where an automaker, service facility and customer would know which motor oil to purchase to recommend and (2) to inform the motor oil buying consumer that the motor oil purchased actually meets the needs of a specific vehicle engine.

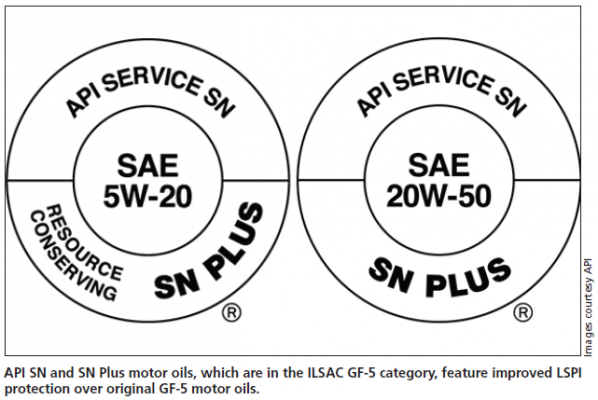

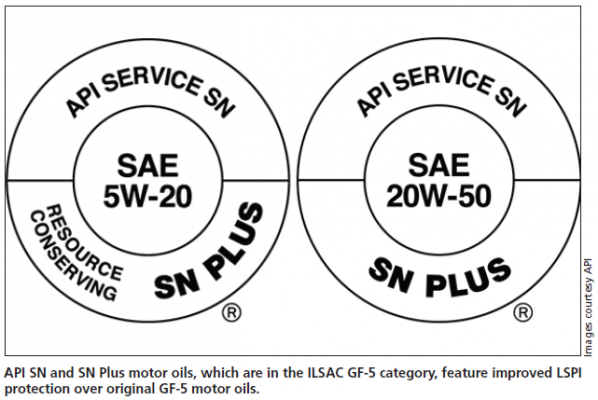

On Nov. 9, 2017, the API Lubricants Standards Group approved the adoption of API SN Plus and SN Plus Resource Conserving (which includes energy-conserving properties SN Plus doesn’t). The first licensing date was May 1 of this year, which is why you may have seen so many announcements recently from oil marketers. To ease any confusion, both SN Plus and SN Plus RC are in the GF-5 category; GF-6, if it’s ever finalized and approved by API, will be designated as SP engine oil.

Better Quality Oils Matter

As you were digesting the alphabet soup above, you might have wondered: Where are the European automakers? In the European Union, the European Automobile Manufacturers Association (ACEA) is the main lobbying and standards group of the automobile industry. They have no representation at API, nor do they have any interest in having any, which poses a challenge for those seeking harmonization of engine oil standards globally, given that vehicles and engines are sold worldwide.

But there’s good reason for this. European synthetic motor oils formulated to ACEA specs use different base oils than their North American synthetic—and even full synthetic—counterparts.

Here’s what we’ve been told about the European engine oil experience with both GDI and TGDI engines using ACEA spec synthetic motor oil, compared to the same engines here in North America on API/ILSAC full synthetic engine oil:

Then ask that owner about his experience regarding the differences in full synthetic oils that are manufactured to European standards vs. North American standards.

There’s a distinct lack of awareness in North America that its full synthetic motor oils may not be equal in quality or performance to those manufactured to European standards. This may be why nearly all American-manufactured full synthetic motor oils have a disclaimer on the label: “This motor oil cannot be sold in Europe.” Engine oil manufacturers are aware of the differences, even if many service and repair professionals and their customers are not.

Service Implications

It’s clear that “full synthetic” is a marketing term that’s not well understood by consumers. It’s also evident that too many motorists—no automotive professionals, one hopes—also don’t appreciate the differences in motor oil quality, espousing an “engine oil is just a commodity; any oil will do” attitude, if you will. Likewise, we’re confident that some shops providing oil change services to owners of European vehicles are using API/ILSAC full synthetics rather than the specific engine oils those vehicle manufacturers recommend.

Both situations are problematic. Customers here who use the lower quality oil end up paying more for maintaining their vehicles (for induction cleaning and engine rebuilding/replacement, for example). Then there’s the negative impact on our image as automotive professionals. We’re expected to know and advise better and then, once they’re fully informed, let our customers choose how to proceed. The questions: Do we, and are we fully informing those we serve?

Dealerships have not previously been under pressure to do what’s right either, from an engine oil perspective, for their TGDI vehicles’ long-term health. Nor are they compelled to be concerned about the vehicle owners lowest long-term cost of ownership. But with the shift to manufacturing a growing number of their vehicles with TGDI engines, domestic and Asian automakers have been pressing their lubricant and additive manufacturing cohorts in API to develop engine oils engineered to address LSPI and other TGDI concerns.

Independent shops often end up dealing with deferred maintenance, which arguably should have been performed earlier but wasn’t. In addition, shops have the difficult task of explaining carbon buildup, excessive sludge formation and other issues to the original or second owner, who had no idea of these potential problems or their cost when the vehicle was purchased.

It’s important to continue the best practice in recommending the correct motor oil to customers and educating them why. It’s also important to continue industry education and having “coffee shop talks” with other shop owners to make them better aware. And we need to work with like-minded industry organizations to educate the public that their choice of motor oil does indeed matter. All three initiatives will expose service and repair facilities that aren’t doing what’s in our customers’ best interest. Consumers need to understand the consequences of using anything less than the right quality engine oil.

For GDI and TGDI engines, manufacturers are selling improved GF-5 category motor oils. But the newly adopted and recently licensed SN Plus and SN Plus Resource Conserving oils are a new classification of GF-5 lubricants, and may be used in conjunction with API SN and API SN Plus RC seals.

According to API, “SN Plus and SN Plus Resource Conserving will be the proper motor oils for your operation. Both make it easier for consumers to select engine oils designed specifically for use with GDI and TGDI engines. And both address resolving LSPI issues, offer improved protection for timing chains, valvetrain components, stop-start engines or any vehicle that features frequent starts and/or starts after extended periods of downtime.”

Both will continue to be labeled GF-5 according to viscosity grade. Also, remember that the only SAE grades covered by GF-5 are SAE 0W-XX, SAE 5W-XX and SAE 10W-30. All ILSAC GF-5 licensed engine oils are now required to properly protect against LSPI, which affects GDI and, to a larger extent, TGDI engines.

“API SN Plus was developed as a lubricant solution to address the issue of low-speed preignition in the field,” notes Matt Timmons, Vice President, OEM Engagement, The Lubrizol Corp. “OEMs required a solution to an increasingly prevalent and severe problem that plagued their vehicles. With the Sequence IX Test for LSPI, those vehicles are now better protected. OEMs have a lubricant solution for an issue that would otherwise require costly, time-consuming and progress-inhibiting engine redesign.

“It’s our hope that the API SN Plus, which was developed for GDI engines, development process illustrates how the lubricant industry can better respond to OEM needs in the future, because we believe that lubricant design and evolution go hand in hand with engine design and evolution,” Timmons added. “API SN Plus Resource Conserving, which includes modifications to address issues specific to TGDI engines, further demonstrates API’s recognition of the need and reaction with a more timely solution for the marketplace, which is a contrast to the protracted development process for ILSAC GF-6.”

GF-6 and Beyond

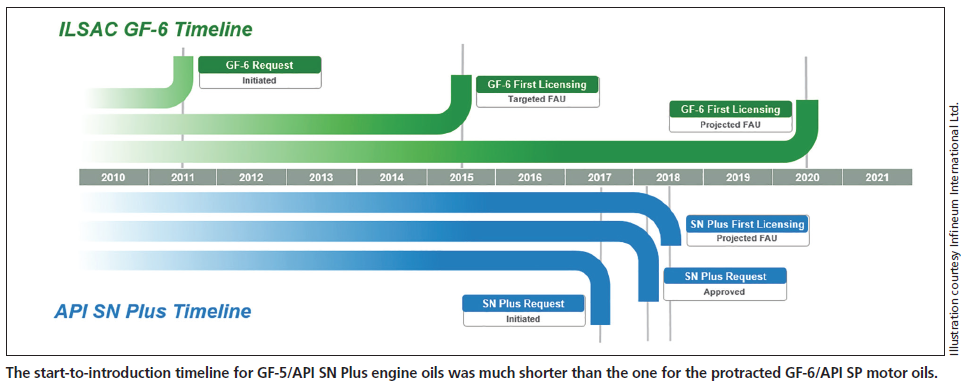

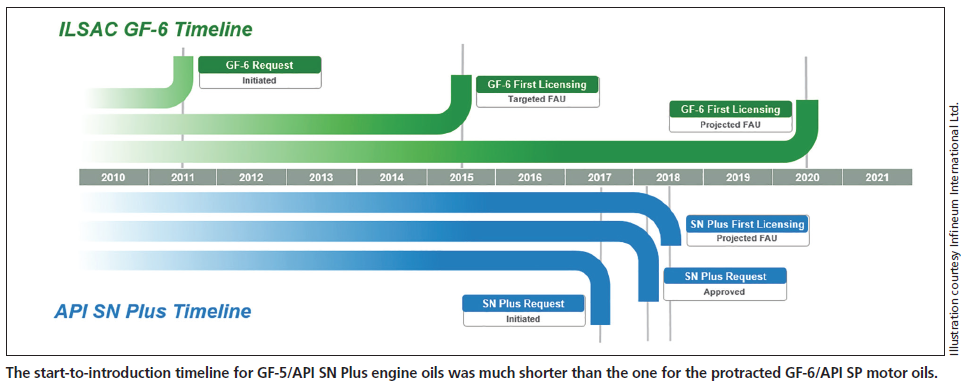

The development of the API’s GF-6, a new category with better quality engine oils than GF-5’s SN Plus and SN Plus Resource Conserving, has been a long and winding road. The project was started in 2012, was intended to be in place by 2016, but has still not been approved.

GF-6 got bogged down in the complexity that resulted from revisions to three of the engine tests involved and the addition of seven new ones. Proponents say not to expect GF-6 until 2020 and are already talking about GF-7. Others remain doubtful whether GF-6 will ever get to market, given the recent trend of new engine types with specific oil requirements being introduced and under development.

ILSAC members have shared that developing a test program for oil marketers to prove that an oil meets the criteria for a new category costs $1 million or more. Also, note that SN Plus and SN Plus Resource Conserving engine oils—based on GF-5 oils already in the market—were both started, developed, approved and introduced in just two years—far less time than the GF-6 process has taken so far.

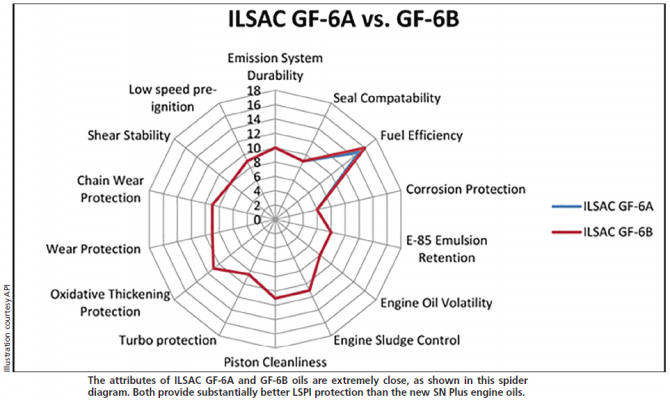

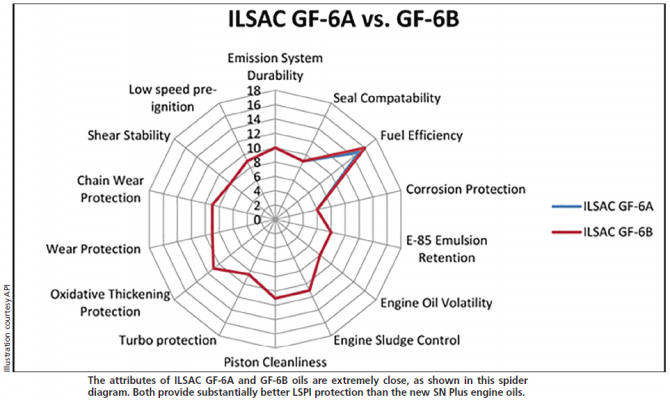

If it ever gets to market, GF-6 will be designated as API SP and be backwards-compatible with all engines using API SN motor oils. GF-6 will actually encompass two potential specifications: GF-6A and GF-6B. The principal difference between the two categories of oils concerns viscosity grade and high-temperature, high-shear (HTHS) performance. GF-6B oils would provide the same performance as GF-6A, but with the added aim of lower HTHS to deliver potential further fuel economy benefits.

But some oil manufacturers, like Lubrizol, say the existing industry model for developing and introducing new engine oil categories is broken and are advocating changing the model itself.

“The impact of the delay in GF-6 is far-reaching and exemplifies the need for earlier, proactive collaboration among OEMs, oil marketers and additive suppliers,” advises Craig Paterson. Vice President, Product Management Warranty, The Lubrizol Corp. “Otherwise, warranty costs will increase. Oil reformulation and testing to solve engine design challenges will become too expensive.

These downsides can be avoided by engaging oil marketers earlier. The prolonged delay in ILSAC GF-6 has highlighted the need for a change in how engine oil specifications are developed, used, deployed and licensed. If we remove complexity from the process, we can become more proactive in meeting the needs of new engine technology. In addition, when an unexpected challenge, such as LSPI, arises after a new engine is introduced, we’ve shown a less cumbersome methodology lets us react to industry needs faster.”

These days, running the right lubricants in the right engines is more important than ever. It’s looking more and more like the Europeans may have had the right idea—specific oils engineered for specific engines. If nothing else, LSPI has shown everyone that the negative impact of operating a TGDI or GDI engine with the wrong oil can be far worse for motorists than merely paying a few more dollars for an optimal oil change.

Back to Summary

Out with the Old: New Oil for New Engines

By Bob Chabot

Motor oil plays a critical role in maintaining the long-term health of the highly stressed engines in newer vehicles. Installing the correct oil has never been of greater importance.

Lubricants, particularly engine motor oils, have become a bit of a puzzle in the past few years. Making sense of the many changes that are in flux can be confusing for you, let alone trying to explain them to customers who own light-duty gasoline-powered cars and light trucks. In many cases, they view an oil change service as a generic commodity. They couldn’t be more wrong. Here’s what you and they need to know today.

Consider for a moment the recent trend toward downsized, gasoline direct injection (GDI) engines that are dominating sales in many vehicle segments today. In particular, focus on the European makes and models you currently service and repair in your shop.

Are you seeing an increase in carbon buildup on engine valves, cylinder blowby, piston scoring and deformation, engine sludge or other poor-quality lubricant-related issues? Are you increasingly selling induction cleaning services and other solutions that help address, but never prevent, those deteriorating incomplete combustion consequences?

Now riddle yourself this: Why are those same makes and models in Europe, which use Euro-spec motor oils, not experiencing the high incidences of these engine issues we are here? Keep your answer in mind as you read on, because we’ll come back to the service implications.

A Major Shift to TGDI

Over the last 15 years, you may have noticed a significant shift to downsized but more powerful GDI engines. But did you pick up on the big shift from GDI to turbocharged GDI (TGDI) engines? Adding turbocharging recovers energy that’s otherwise lost through exhaust systems, to achieve even greater fuel efficiency.

Consider this data shared by Mark Seng, Global Aftermarket Practice Leader for IHS Automotive, a leading market researcher: “In 2016, there were 25.5 million registered passenger cars in the U.S. powered by TGDI and GDI engines. By 2024, after consulting with automakers, IHS predicts eight out of 10 cars produced in America will be equipped with TGDI and GDI engines. By 2024, we expect that vehicles equipped with TGDI and GDI engines will make up 83% of the U.S. vehicle population. That’s the majority of vehicles coming through service facility doors for oil changes.”

Seng cited two market forces that are driving this automaker shift toward these smaller, lighter TGDI engines. First, automakers are formulating production plans designed to meet the challenging 2025 regulatory fuel economy requirement of 54.5 mpg. Second, consumer demand for more efficient and better performing engines has continued to grow.

TGDI engine technology delivers on both counts. A 4-cylinder TGDI engine can generate the same levels of torque as its 6-cylinder port fuel injected (PFI) counterpart. But that power comes at a price—a much harsher engine environment. TGDI engines produce greater cylinder pressures, higher operating speeds and higher sustained temperatures than PFI engines. Simply put, pistons and connecting rods are breaking.

“GDI and TGDI engines now make up over half of new-car production,” shared Mike Krampf, Finished Lube Manager for Phillips 66. “More than 120 million TGDI-powered vehicles have been manufactured since 2010. These are smaller and more powerful engines, but they also run hotter. In addition, the high pressures from turbocharging combined with direct fuel injection in these smaller TGDI engines make them susceptible to detrimental conditions.” For example:

- Due to changes in injection and combustion, TGDI engines produce increased soot and fuel dilution. The soot can cause a rapid increase in the viscosity of the oil, while the increased fuel dilution can accelerate wear during and after injection.

- Accelerated timing chain wear is another commonly occurring problem. Compared to normal expected wear to the timing chain over time, with TGDI engines, wear is much more rapid and premature.

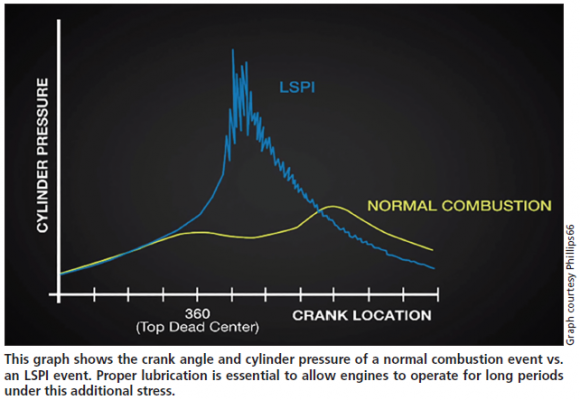

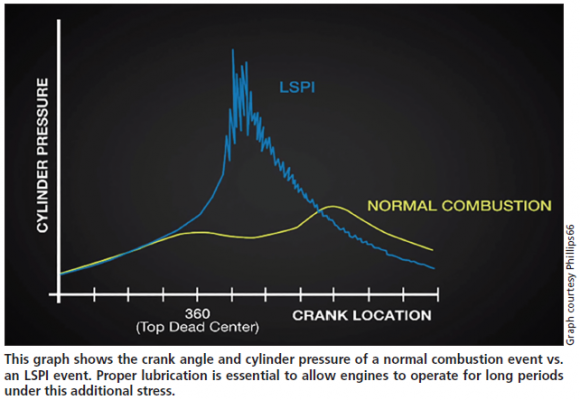

- And then there’s the specter of low-speed preignition (LSPI), which is an unexpected consequence of downsizing and boosting engines. Also known as stochastic preignition (SPI), LSPI is caused by droplets or particles of fuel and oil in the combustion chamber igniting prior to spark, resulting in uncontrolled, abnormal combustion and a spike in engine pressure that ultimately causes internal damage. Pistons and connecting rods are breaking, and researchers have found that just a single LSPI event was sufficient to cause severe engine damage.

To sustain the shift to TGDI engines, carmakers need motor oils engineered to prevent or sufficiently mitigate these issues—specifically, higher performing oils under TGDI

engine operating conditions, with improved oxidation control, cleaning and antiwear properties—so that combustion can be controlled.

Harsher Operating Conditions

Acronyms and terms like API, ILSAC, ACEA, GF-6B, SN Plus, SN Plus RC and others can be a confusing alphabet soup for those like us who just want an easy-to-understand guide to know what motor oil is best for the customers we serve.

The American Petroleum Industry (API) is the primary standards body for engine oil in North America only.

Its members include some automakers, lubricant manufacturers and additive makers. API uses an alphanumeric system to indicate superseding, backwards-compatible approval: API SN is newer than and can be used in older engines using API SM, which is newer than and can be used in older engines using API SL, etc.

Within API, the International Lubricants Standardization and Approval Committee (ILSAC) represents the interest of American and Japanese manufacturers. ILSAC also uses an alphanumeric system to indicate superseding, backwards-compatible approval: ILSAC GF-6 is newer than and can be used in older engines using ILSAC GF-5, which is newer than and can be used in older engines using GF-4, etc.

Historically, the API member automakers (domestic and Asian) have wanted a single lubricant designation for motor oil generations—categorized by specific viscosities, fuel economy benefits, emissions and engine oil robustness. Based on this request, the API developed the GF series of engine oil categories. The intent was (1) to use this system as a guide to reach common ground where an automaker, service facility and customer would know which motor oil to purchase to recommend and (2) to inform the motor oil buying consumer that the motor oil purchased actually meets the needs of a specific vehicle engine.

On Nov. 9, 2017, the API Lubricants Standards Group approved the adoption of API SN Plus and SN Plus Resource Conserving (which includes energy-conserving properties SN Plus doesn’t). The first licensing date was May 1 of this year, which is why you may have seen so many announcements recently from oil marketers. To ease any confusion, both SN Plus and SN Plus RC are in the GF-5 category; GF-6, if it’s ever finalized and approved by API, will be designated as SP engine oil.

Better Quality Oils Matter

As you were digesting the alphabet soup above, you might have wondered: Where are the European automakers? In the European Union, the European Automobile Manufacturers Association (ACEA) is the main lobbying and standards group of the automobile industry. They have no representation at API, nor do they have any interest in having any, which poses a challenge for those seeking harmonization of engine oil standards globally, given that vehicles and engines are sold worldwide.

But there’s good reason for this. European synthetic motor oils formulated to ACEA specs use different base oils than their North American synthetic—and even full synthetic—counterparts.

Here’s what we’ve been told about the European engine oil experience with both GDI and TGDI engines using ACEA spec synthetic motor oil, compared to the same engines here in North America on API/ILSAC full synthetic engine oil:

- The engines in Europe perform better and last longer.

- The engines in Europe don’t have incomplete combustion issues.

- Over their lifetime, it costs less to maintain GDI and TGDI engines in Europe.

Then ask that owner about his experience regarding the differences in full synthetic oils that are manufactured to European standards vs. North American standards.

There’s a distinct lack of awareness in North America that its full synthetic motor oils may not be equal in quality or performance to those manufactured to European standards. This may be why nearly all American-manufactured full synthetic motor oils have a disclaimer on the label: “This motor oil cannot be sold in Europe.” Engine oil manufacturers are aware of the differences, even if many service and repair professionals and their customers are not.

Service Implications

It’s clear that “full synthetic” is a marketing term that’s not well understood by consumers. It’s also evident that too many motorists—no automotive professionals, one hopes—also don’t appreciate the differences in motor oil quality, espousing an “engine oil is just a commodity; any oil will do” attitude, if you will. Likewise, we’re confident that some shops providing oil change services to owners of European vehicles are using API/ILSAC full synthetics rather than the specific engine oils those vehicle manufacturers recommend.

Both situations are problematic. Customers here who use the lower quality oil end up paying more for maintaining their vehicles (for induction cleaning and engine rebuilding/replacement, for example). Then there’s the negative impact on our image as automotive professionals. We’re expected to know and advise better and then, once they’re fully informed, let our customers choose how to proceed. The questions: Do we, and are we fully informing those we serve?

Dealerships have not previously been under pressure to do what’s right either, from an engine oil perspective, for their TGDI vehicles’ long-term health. Nor are they compelled to be concerned about the vehicle owners lowest long-term cost of ownership. But with the shift to manufacturing a growing number of their vehicles with TGDI engines, domestic and Asian automakers have been pressing their lubricant and additive manufacturing cohorts in API to develop engine oils engineered to address LSPI and other TGDI concerns.

Independent shops often end up dealing with deferred maintenance, which arguably should have been performed earlier but wasn’t. In addition, shops have the difficult task of explaining carbon buildup, excessive sludge formation and other issues to the original or second owner, who had no idea of these potential problems or their cost when the vehicle was purchased.

It’s important to continue the best practice in recommending the correct motor oil to customers and educating them why. It’s also important to continue industry education and having “coffee shop talks” with other shop owners to make them better aware. And we need to work with like-minded industry organizations to educate the public that their choice of motor oil does indeed matter. All three initiatives will expose service and repair facilities that aren’t doing what’s in our customers’ best interest. Consumers need to understand the consequences of using anything less than the right quality engine oil.

For GDI and TGDI engines, manufacturers are selling improved GF-5 category motor oils. But the newly adopted and recently licensed SN Plus and SN Plus Resource Conserving oils are a new classification of GF-5 lubricants, and may be used in conjunction with API SN and API SN Plus RC seals.

According to API, “SN Plus and SN Plus Resource Conserving will be the proper motor oils for your operation. Both make it easier for consumers to select engine oils designed specifically for use with GDI and TGDI engines. And both address resolving LSPI issues, offer improved protection for timing chains, valvetrain components, stop-start engines or any vehicle that features frequent starts and/or starts after extended periods of downtime.”

Both will continue to be labeled GF-5 according to viscosity grade. Also, remember that the only SAE grades covered by GF-5 are SAE 0W-XX, SAE 5W-XX and SAE 10W-30. All ILSAC GF-5 licensed engine oils are now required to properly protect against LSPI, which affects GDI and, to a larger extent, TGDI engines.

“API SN Plus was developed as a lubricant solution to address the issue of low-speed preignition in the field,” notes Matt Timmons, Vice President, OEM Engagement, The Lubrizol Corp. “OEMs required a solution to an increasingly prevalent and severe problem that plagued their vehicles. With the Sequence IX Test for LSPI, those vehicles are now better protected. OEMs have a lubricant solution for an issue that would otherwise require costly, time-consuming and progress-inhibiting engine redesign.

“It’s our hope that the API SN Plus, which was developed for GDI engines, development process illustrates how the lubricant industry can better respond to OEM needs in the future, because we believe that lubricant design and evolution go hand in hand with engine design and evolution,” Timmons added. “API SN Plus Resource Conserving, which includes modifications to address issues specific to TGDI engines, further demonstrates API’s recognition of the need and reaction with a more timely solution for the marketplace, which is a contrast to the protracted development process for ILSAC GF-6.”

GF-6 and Beyond

The development of the API’s GF-6, a new category with better quality engine oils than GF-5’s SN Plus and SN Plus Resource Conserving, has been a long and winding road. The project was started in 2012, was intended to be in place by 2016, but has still not been approved.

GF-6 got bogged down in the complexity that resulted from revisions to three of the engine tests involved and the addition of seven new ones. Proponents say not to expect GF-6 until 2020 and are already talking about GF-7. Others remain doubtful whether GF-6 will ever get to market, given the recent trend of new engine types with specific oil requirements being introduced and under development.

ILSAC members have shared that developing a test program for oil marketers to prove that an oil meets the criteria for a new category costs $1 million or more. Also, note that SN Plus and SN Plus Resource Conserving engine oils—based on GF-5 oils already in the market—were both started, developed, approved and introduced in just two years—far less time than the GF-6 process has taken so far.

If it ever gets to market, GF-6 will be designated as API SP and be backwards-compatible with all engines using API SN motor oils. GF-6 will actually encompass two potential specifications: GF-6A and GF-6B. The principal difference between the two categories of oils concerns viscosity grade and high-temperature, high-shear (HTHS) performance. GF-6B oils would provide the same performance as GF-6A, but with the added aim of lower HTHS to deliver potential further fuel economy benefits.

But some oil manufacturers, like Lubrizol, say the existing industry model for developing and introducing new engine oil categories is broken and are advocating changing the model itself.

“The impact of the delay in GF-6 is far-reaching and exemplifies the need for earlier, proactive collaboration among OEMs, oil marketers and additive suppliers,” advises Craig Paterson. Vice President, Product Management Warranty, The Lubrizol Corp. “Otherwise, warranty costs will increase. Oil reformulation and testing to solve engine design challenges will become too expensive.

These downsides can be avoided by engaging oil marketers earlier. The prolonged delay in ILSAC GF-6 has highlighted the need for a change in how engine oil specifications are developed, used, deployed and licensed. If we remove complexity from the process, we can become more proactive in meeting the needs of new engine technology. In addition, when an unexpected challenge, such as LSPI, arises after a new engine is introduced, we’ve shown a less cumbersome methodology lets us react to industry needs faster.”

These days, running the right lubricants in the right engines is more important than ever. It’s looking more and more like the Europeans may have had the right idea—specific oils engineered for specific engines. If nothing else, LSPI has shown everyone that the negative impact of operating a TGDI or GDI engine with the wrong oil can be far worse for motorists than merely paying a few more dollars for an optimal oil change.