You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Affording a Raptor

- Thread starter SupraDreams2

- Start date

Disclaimer: Links on this page pointing to Amazon, eBay and other sites may include affiliate code. If you click them and make a purchase, we may earn a small commission.

Frogger22

“Not all who wander are lost” Tolkien

That's part of my reasoning for looking at Raptors, they are (in a way) just f150s not corvettes. I hope they depreciate with the new 2017 coming out, hopefully down to mid 20s.

You know SupraDreams2 for being 22 years old....you surely act 22 years old :********:

SupraDreams2

Member

- Joined

- Oct 10, 2015

- Posts

- 8

- Reaction score

- 2

Yeah, there's a lot I still don't know.

Aaron313

Full Access Member

Mid 20's for a raptor? Salvage title with a lot of miles will get you there. Kinda crazy how my truck is going to be 6 years old in couple months and a dodge dealership in my town offered me 39k for trade in.

Sent from my iPhone 6s using Tapatalk

Sent from my iPhone 6s using Tapatalk

SupraDreams2

Member

- Joined

- Oct 10, 2015

- Posts

- 8

- Reaction score

- 2

Mid 20's for a raptor? Salvage title with a lot of miles will get you there. Kinda crazy how my truck is going to be 6 years old in couple months and a dodge dealership in my town offered me 39k for trade in.

Sent from my iPhone 6s using Tapatalk

So it's more likely that they'll bottom out at high 30s? That seems to be the norm for 2010s-2011s. 36-42k. I also don't really have a concept of how much that is for a truck, since most of the cars my family has bought have been under 10k.

aj.cruz

Full Access Member

This has nothing to do with Raptors, but here's my career advice for what it's worth (nothing to most I'm sure):

I was once shown a Vennn diagram by a CIO of my former company while he was giving me career advice (yes, that's a bad place to be). He drew three circles, one is what you're good at, one is what you love, one is what makes money. He said AJ, the best place for you to be is right in the middle of where all three intersect.

Debatable, but for the most part I agree with one caveat-

I've discovered that most people for some reason pigeonhole themselves into a given station in life. They say this is what I'm good at, I was born with these talents, I need to work within these confines.

TOTAL BS

You. Can. Be. Amazing. At. Whatever. You. Want.

It's just a matter of how bad you want it and therefore how much time you're willing to spend developing your talent.

Also, the job market is called a job market because it's, surprise a market. Like any market it works on the basis of supply and demand. Basic economics tell us if demand is high and market supply is low, the thing being supplied is of great value.

So here's my advice (finally). Find out what you love (maybe there are several). Analyze the market and make an educated decision on what is and will be in demand with relatively few workers in supply. And then become the best at whatever that is.

Technology is a good place to be. The Internet of Things is exploding, everything is becoming connected, the demand for engineers is high and is only going up in the foreseeable future.

I'm 35. I have no college degree (ie no debt woo). I have several IT certifications including my CCIE. I won't say my salary for fear of sounding like a ******, but I'll say I make more than my lawyer brother. He's an IP lawyer at IBM with a mountain of debt.

I'll finish off with this. Your skill is why people hire you, it's not why they keep you and give you raises year after year and promote you. Get rid of your ego (not saying you have a problem with that). Logic over emotion. Always look for ways to help/serve people. Build people up, NEVER tear people down even when they deserve it.

Do all that and I promise you'll find success and happiness.

Good luck.

Edit: Scratch that last comment, luck has nothing to do with it.

Go get it!

I was once shown a Vennn diagram by a CIO of my former company while he was giving me career advice (yes, that's a bad place to be). He drew three circles, one is what you're good at, one is what you love, one is what makes money. He said AJ, the best place for you to be is right in the middle of where all three intersect.

Debatable, but for the most part I agree with one caveat-

I've discovered that most people for some reason pigeonhole themselves into a given station in life. They say this is what I'm good at, I was born with these talents, I need to work within these confines.

TOTAL BS

You. Can. Be. Amazing. At. Whatever. You. Want.

It's just a matter of how bad you want it and therefore how much time you're willing to spend developing your talent.

Also, the job market is called a job market because it's, surprise a market. Like any market it works on the basis of supply and demand. Basic economics tell us if demand is high and market supply is low, the thing being supplied is of great value.

So here's my advice (finally). Find out what you love (maybe there are several). Analyze the market and make an educated decision on what is and will be in demand with relatively few workers in supply. And then become the best at whatever that is.

Technology is a good place to be. The Internet of Things is exploding, everything is becoming connected, the demand for engineers is high and is only going up in the foreseeable future.

I'm 35. I have no college degree (ie no debt woo). I have several IT certifications including my CCIE. I won't say my salary for fear of sounding like a ******, but I'll say I make more than my lawyer brother. He's an IP lawyer at IBM with a mountain of debt.

I'll finish off with this. Your skill is why people hire you, it's not why they keep you and give you raises year after year and promote you. Get rid of your ego (not saying you have a problem with that). Logic over emotion. Always look for ways to help/serve people. Build people up, NEVER tear people down even when they deserve it.

Do all that and I promise you'll find success and happiness.

Good luck.

Edit: Scratch that last comment, luck has nothing to do with it.

Go get it!

Last edited:

D

Deleted member 12951

Guest

CCIE, great cert to have to get you in the 6 figures but few obtain since its hard work to get there. I have a bunch of certs in the Microsoft field and its done very well for me but at 22yrs, I was lucky to be making anything close to now.

Even at my age, it took awhile to build up to a raptor. I would buy a new and more expensive truck every 3yrs until my 4th truck had enough equity that I was able to put a sizable trade amount towards the raptor. Definitely look into what insurance is going to cost and gas depending how much you plan on driving it if its your daily driver. Those two for me gets close to the truck payment alone.

Even at my age, it took awhile to build up to a raptor. I would buy a new and more expensive truck every 3yrs until my 4th truck had enough equity that I was able to put a sizable trade amount towards the raptor. Definitely look into what insurance is going to cost and gas depending how much you plan on driving it if its your daily driver. Those two for me gets close to the truck payment alone.

jschell1309

Full Access Member

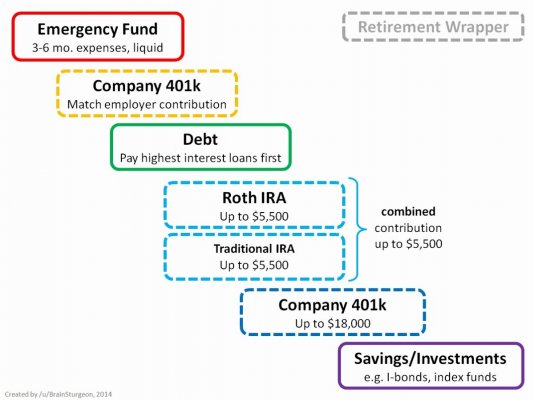

This is a simple flow chart to follow for someone just graduating. People in the newest generation really have to focus on tax advantaged investments (401k, IRA, Roth IRA) as they no longer get a company pension and who knows where Social Security will be in 50+ years.

1. Make an emergency fund for 3-6 months expenses. Keep this liquid in a local bank. Never touch it. It will only gain 1% and will lose to inflation. However you don't care, it is liquid as an emergency. Car breaks down, medical bill, house repair, or worst case you lose your job that money is there and ready to go.

2. If you have a job with an employer matched 401k put in enough money to get that match immediately. This is "free" money and no reason to not hit the match to start.

3. This is what you are already planning for, student loans and car payments. Pay down your highest interest loan first (5% or more). You already have your emergency savings to fall back on and a start to retirement savings with 401k. It's time to focus on eliminating all loans asap. Some like to try to save and invest at the same time. I like to look at this as "reverse investing". By paying these down you are investing in your future and eliminating that interest. You have student loans because you wanted an education. If that education got you a better paying job and potential career than if you didn't, then it was a wise investment for your future.

4. Open a Roth IRA through Vanguard and just put it in a simple mutual fund such as their target retirement date funds. They have a goal year such as 2055 and a mix of stocks and bonds that will change and be less risky as you approach that year. If you know nothing about investing these are an amazing first step into the world. Max this out at the current $5,500 annual limit.

5. Continue to put money into your company 401k until you hit the current max of $18k. Between this and your Roth IRA you have a great mix of tax advantaged investments to pull from in retirement.

6. Save for a house, personal taxed investments, or a nice vehicle and a shitload of parts for it. If you can make it to this point you are already doing better than 90% of your generation. Now you can enjoy the expendable money you have. Life's too short to pack away every penny, spend some money on hobbies to spend your time with.

13raptorcrew

Full Access Member

I guess I'm one of those 'engineering kiddos'... but working my ass off to get the truck that I wanted was the most important (and still is).

ZeusMutation

Member

- Joined

- Oct 20, 2015

- Posts

- 25

- Reaction score

- 3

Lot's of good advice here...

Hard not to dream & drool over all the stuff we can buy these day... especially in ones early 20's.

I personally think you should put the Raptor on ice for like 10 years.. You'll love 100+ things along the way.

Our ability to self justify is an amazing and complex behavior. If you can fight the urges to consume... well, save, save, and save... earning potential from an employer has a shelf life. Try starting a business or diversify your earning into areas that can provide a healthy return.

Hard not to dream & drool over all the stuff we can buy these day... especially in ones early 20's.

I personally think you should put the Raptor on ice for like 10 years.. You'll love 100+ things along the way.

Our ability to self justify is an amazing and complex behavior. If you can fight the urges to consume... well, save, save, and save... earning potential from an employer has a shelf life. Try starting a business or diversify your earning into areas that can provide a healthy return.

Similar threads

- Replies

- 33

- Views

- 3K

- Replies

- 11

- Views

- 2K

- Replies

- 27

- Views

- 2K

- Replies

- 1

- Views

- 880

- Replies

- 7

- Views

- 1K